About Incentives

Most folks don’t plan, they don’t know what to do or who to call, or they imagine it is too expensive. What is more, government overlooks the needs of the aging middle class, only focusing on the serious needs of the elderly poor. Very few programs motivate consumers to update their homes to plan for longevity so they can age in place.

HomesRenewed Coalition advocates incentives as the motivator:

- Incentives are used all the time. You get a break on your health insurance if you don’t smoke, your car insurance if you drive well and your homeowners insurance if you have an alarm system. You should get a break if your home is safer and will save health care dollars.

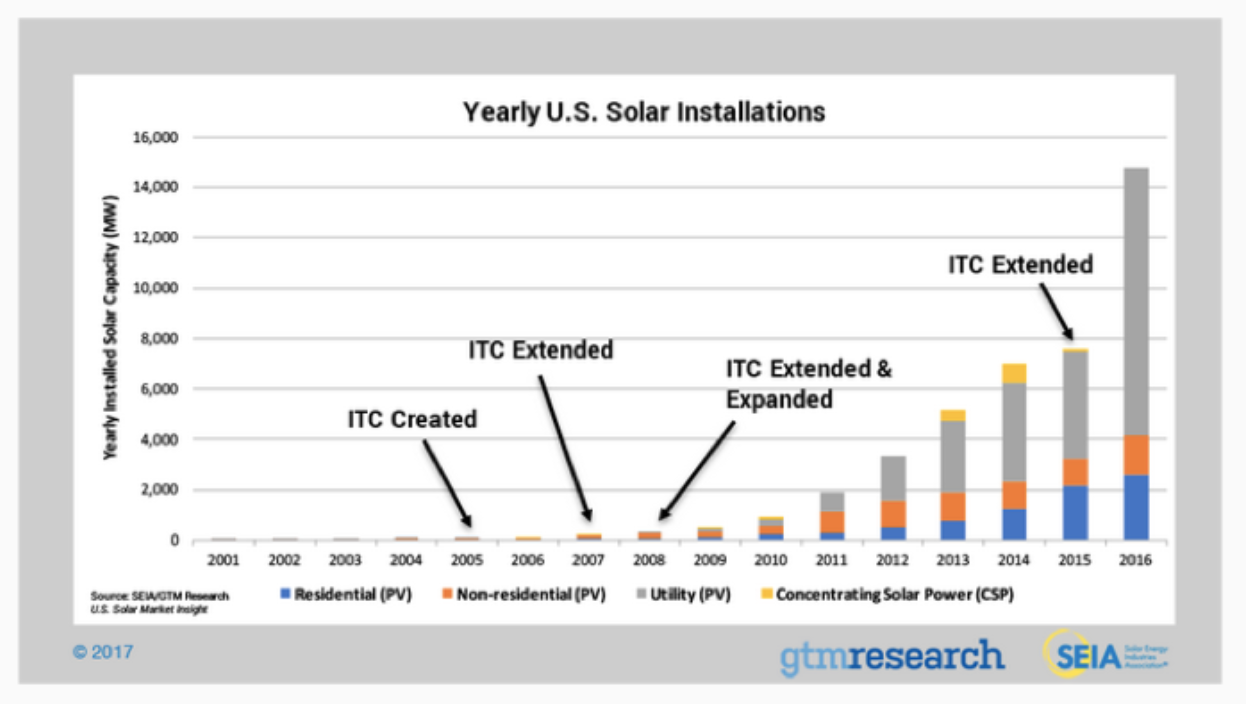

- The solar and hybrid car industries took off like rockets when tax credits incentives were introduced.

Types of Policy Incentives

- Use of Retirement Savings to update your home without tax or penalty

- 401K, IRA, and TSP are all your savings, earmarked for retirement. This incentive helps your liquid assets turn your real estate into a better tool for your retirement.

- Income tax credits

- Reduced permit and impact fees.

- Expedited applications.

- Property tax credits.

- Allowing use of setback areas for accessibility improvements

- Accessory Dwelling Unit promotions

Private Incentives

Privately sponsored incentives have a history of evolving into policy and requirements when value is proven out in the marketplace.

- Airbags were first a luxury option on Cadillacs, were then supported by insurance and are now required

- Smoke detectors were first adopted by techies then supported by insurance and now required

- Back up cameras were a high priced techie option and are now required on new cars

HomesRenewed is working with Long Term Care and health insurers to pilot incentive programs so we can get more evidence to show legislators.